How much will college cost?

May 20, 2023

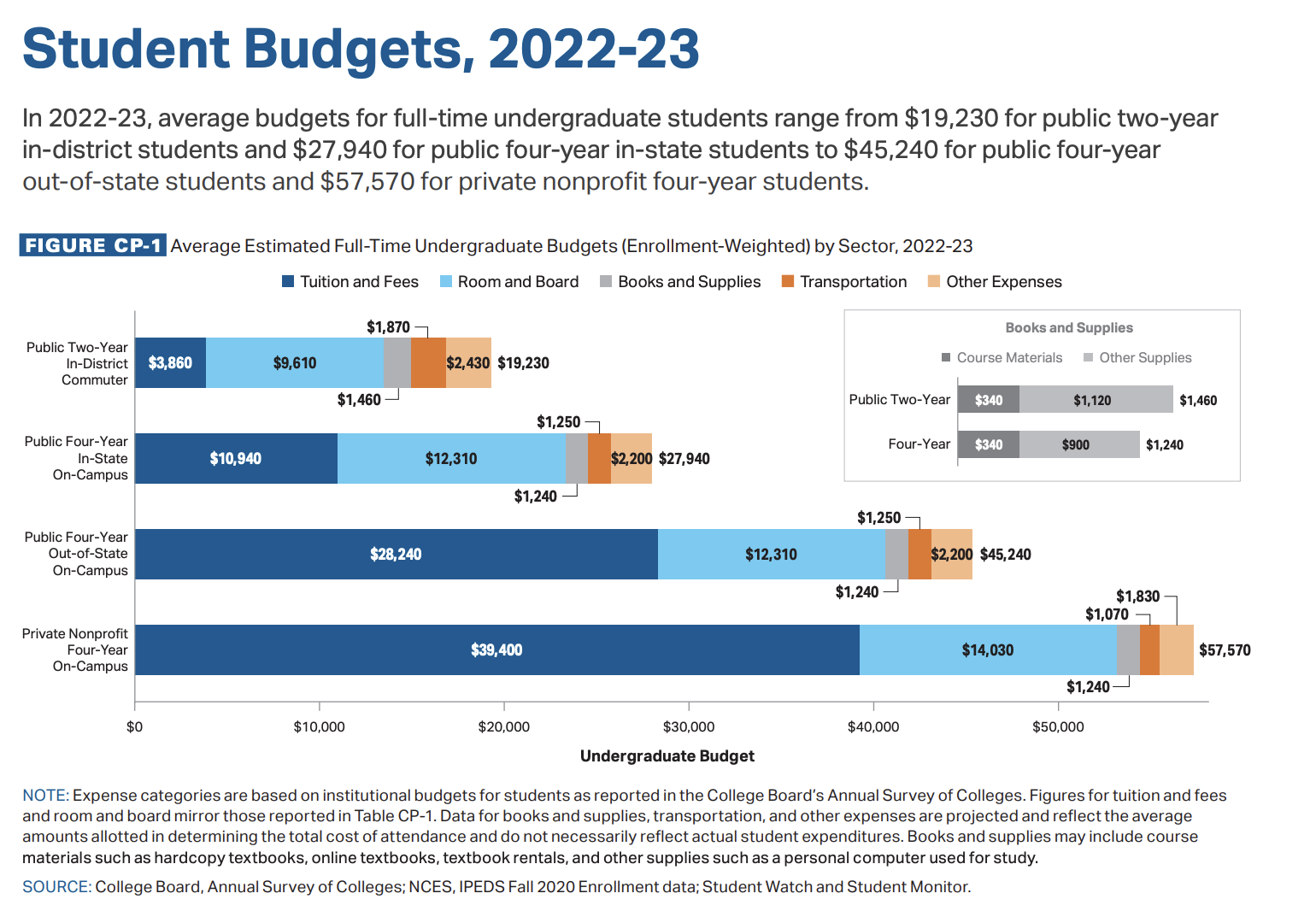

In 2022, the College Board reported the average public 4-year in-state, on-campus “all in” college cost was $27, 940. When we originally wrote this article in 2017, the cost was $24,610. For private schools, the cost was $53,980 ($49,320 in 2017). So what does “all in” mean? Aren’t we just looking at tuition and room and board? Nope. In order to answer the question “how much will college cost?”, we must take a closer look at all the parts included in this pricing.

Source: https://research.collegeboard.org/media/pdf/trends-in-college-pricing-student-aid-2022.pdf

Tuition

Tuition is the first thing you think of when considering college costs. Tuition is simply the cost of college instruction and is based on a unit cost like per credit hour. The average per-hour credit cost varies widely dependent on the type of university your student attends.

Out-of-state tuition is roughly twice as expensive as in-state tuition. Some colleges have agreements to recognize out-of-state students at the in-state rate.

Full-time students are often charged a flat rate for tuition–covering anywhere from 12 to 18 credits. If a student takes less than 12 credit hours, they will pay the per credit hour price. If they take more than 18 credits, they will pay the flat rate plus any extra. The details vary from school to school.

Full-time students paying a flat rate need to be sure to get their money’s worth. Taking 18 credit hours provides the most bang for their buck but may be a strain on their workload. Taking only 12 hours may be costing them more per credit hour than if they didn’t have the flat rate, and they probably won’t graduate in four years if taking only 12 hours per semester.

Room and Board

Probably room and board. Your student needs a place to sleep/live and food to eat. Pretty straight forward? Maybe not.

For freshmen, deciding where to live their first year is usually not an option. The majority of colleges will require students live on-campus unless their home is close to the campus (often within 50 miles). An increasing number of colleges are also requiring sophomores to stay in the dorms.

On-campus housing is usually more expensive than having an apartment off campus, but it can avoid unanticipated costs and be more convenient. Another benefit is resident assistant supervision and support.

The price of housing and meals makes “up a large proportion of the increase in the cost” of college. While governments are blustering about rising college costs and colleges make grand announcements about freezing tuition, room charges remain unchecked increasing faster than the rate of inflation.

Colleges are building impressive new dorms with all the amenities to attract students. Hello rock climbing walls and lazy rivers! In this highly competitive environment where colleges must attract students to survive, they are in an arms race of amenities. And costs increase as a result.

When researching colleges, examine their different room options and costs. They will usually spell out the various choices on their websites.

Living off campus might save some money. The rent is lower, but remember additional costs like parking, gas, utility bills, absent roommates, and summer rent can come as a surprise.

Now to one of a college student’s favorite topics…food!

Referred to as “board,” meal plan choices allow for a lot of customization for your student. What kind of an eater is your student? How often will they visit a dining hall? Do they eat three meals a day? Or maybe all day long? Maybe an unlimited plan is right for them. Maybe they only eat twice a day and not on weekends? Then a meal plan with a certain number of swipes per week may be adequate.

Meal plan choices allow a student to eat at the university’s dining hall facilities, and colleges have created a vast array of options in their meal plans. A peek at Temple’s meal plan website, showed a slew different meal plan options to choose from. Talk about customization!

In today’s college world, students also have access to many different chain restaurants on campus–Starbucks, Panda Express, and Subway to name a few. As part of many meal plans, colleges will include “dining dollars” or funds that students can use at these specialty eateries.

Finally, when students decide to not live on campus anymore, they will be in the real world of grocery shopping, eating out, and budgeting. A time for life lessons!

How do parents want to handle the food costs? You may want to give your student a lump sum amount at the beginning of the semester and allow your student to be responsible for their budget. You may want to do a per month or per week “food allowance” or you may even want your student to be responsible for this cost themselves. Depends on what will work best for your student and your family.

Rather than taking a stab in the dark at an estimated cost, try to get a handle on the cost to feed them when they are at home and use that as a base.

Now fees…

College fees are very diverse. They are the hidden cost you may not always be aware of and may add up to $2,000 or $3,000 to the total price.

They can include (quite a list!):

- Course fees (science labs or art classes)

- Parking on campus

- Orientation

- Student ID

- Library

- Campus facilities & transportation (like a campus shuttle)

- Environmental fees

- Support programs

- Legal services

- Computer or tech fees (wi-fi)

- Commencement

- Student government

- Athletics or spirit programs

- Health insurance

Not all colleges will charge for all of these…this is just a sampling. When looking at a college’s website, know that the estimated fees listed may vary for your student based on what courses they select. Some fees will be waivable like health insurance, but most are mandatory.

Textbooks

In the 2022 report from the College Board referenced above, the average annual cost for college textbooks at a 4-year university was $1,240. Online digital textbooks are a great option, and we are seeing more and more of them. One of the culprits for rising textbook costs are books bundled with “access codes.” The access codes expire at the end of the semester so students cannot resell the book.

On-campus bookstores will be the most convenient, but they may be the most expensive option. You can also check out other options like renting books, used books, or shopping websites like Chegg.com orAmazon.com to save on costs.

529 tip: Be sure to save those textbook receipts to reimburse your purchase with funds from your 529 plan. Books are a qualified expense. Request reimbursement the same year as the purchase.

Personal and Transportation Expenses

Another college cost is personal and transportation expenses. You will see them on a college’s website. These numbers are estimates created by colleges to capture other things students may need to pay for when they go to college including clothing, personal items, and entertainment.

Although hard to estimate, be aware of the additional costs you will face. Cities will be more expensive with a higher standard of living and extras like public transportation. Certain regions of the country will be more expensive than others as well. If your student is going to college far away, you’ll want to keep possible transportation costs to and from in mind as well.

When pulling all these number together, remember the sticker price is rarely what you’ll pay. But understanding college costs gives you a starting point in your research and college search.

Understanding Tuition Discounts

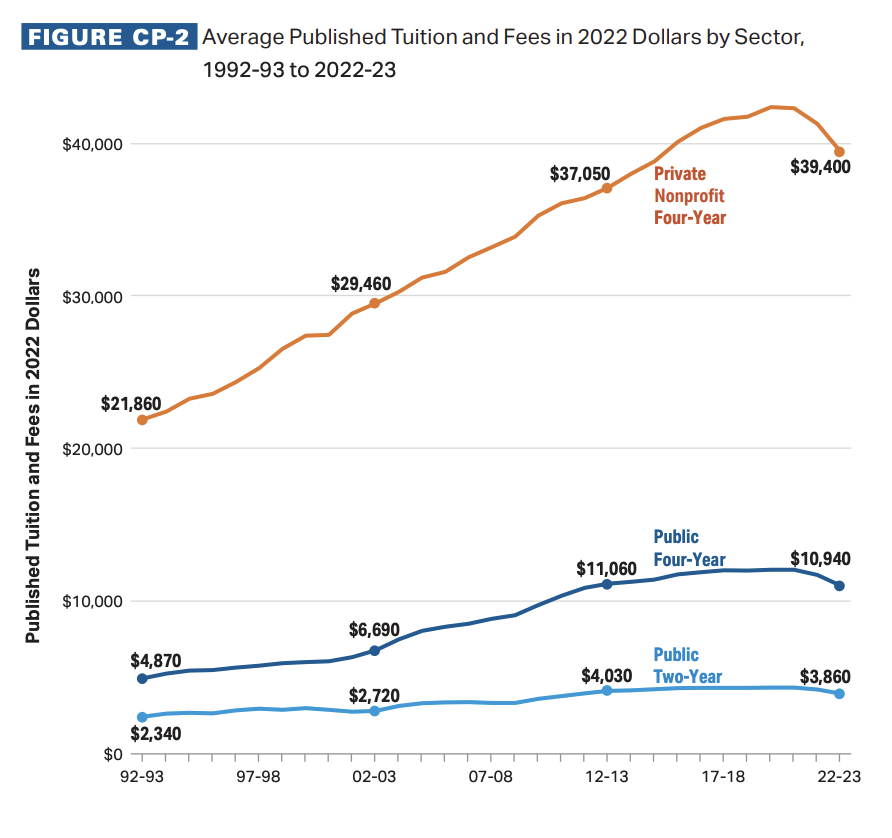

One key takeaway from all of this data is that the cost of tuition, room and board, and general costs of attending college are on the rise.

However, it’s also true that the average tuition discounts offered by private colleges are also on the rise. For example, a NACUBO study recently found that private college discount rates recently hit an all-time high at 56.2%.

Knowing this can help you to get a better idea of the “all-in” pricing of different colleges and universities (public, private, or otherwise) as you continue your search.

Not sure how to learn more about potential tuition discounts?.

Remember: even with the cost of tuition steadily increasing, you can still make an empowered choice about college for your family that sets your kids up for future success.

Have questions about college planing? Reach out to us today by clicking here. We’d love to learn more about how we can help you navigate the college landscape.

Bernie Ross

Bernie is a leading authority on late-stage college funding. He is a frequent speaker to many local high schools in the Southern NH and Merrimack Valley MA regions. With 25 years of experience as a Financial Advisor Bernie has helped many families reduce the cost of college through strategies that increase Financial Aid (even if they think they make to much money) and develop a plan on how to pay for college without derailing their Retirement Planning goals.

Bernie is a leading authority on late-stage college funding. He is a frequent speaker to many local high schools in the Southern NH and Merrimack Valley MA regions. With 25 years of experience as a Financial Advisor Bernie has helped many families reduce the cost of college through strategies that increase Financial Aid (even if they think they make to much money) and develop a plan on how to pay for college without derailing their Retirement Planning goals.